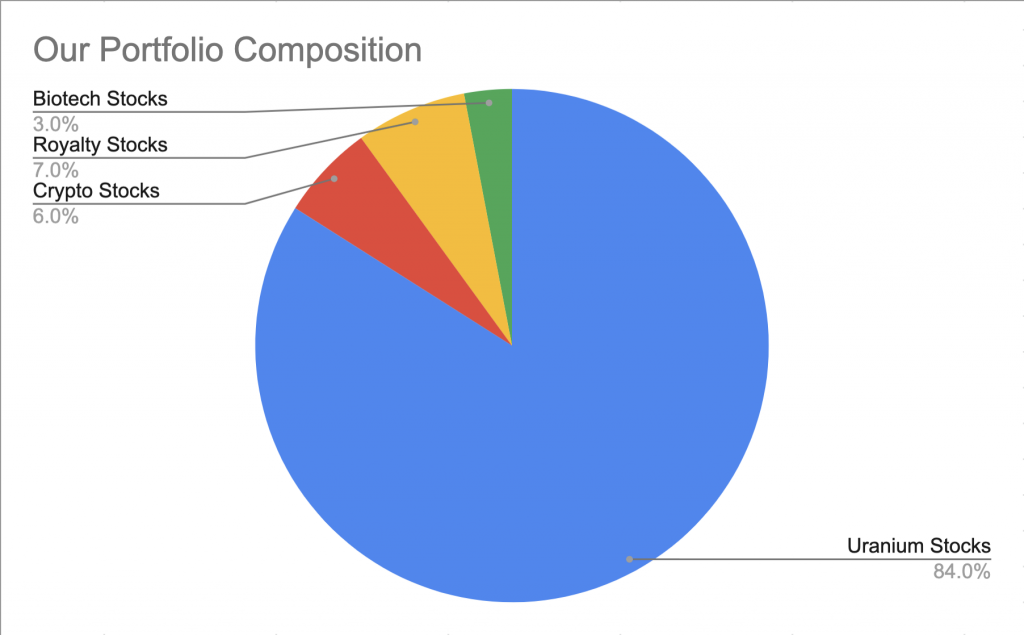

To say we are heavily invested in uranium stocks is an understatement. Here is our current portfolio composition:

I suppose its fair enough to say “All I want is U…ranium”

A Private Buywrite Fund focused on Uranium, Silver and Bitcoin Equities

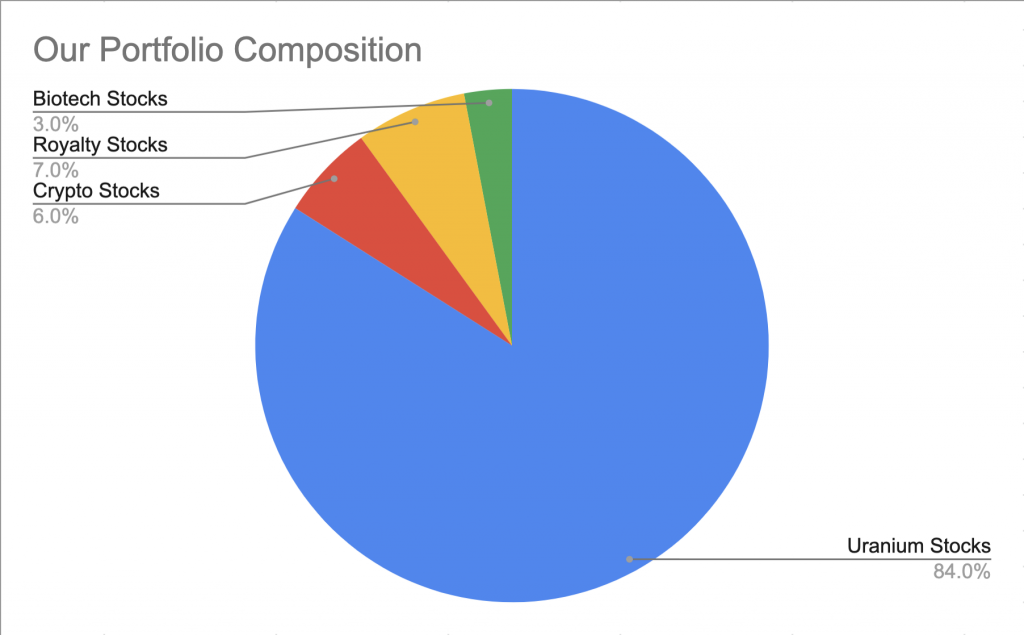

To say we are heavily invested in uranium stocks is an understatement. Here is our current portfolio composition:

I suppose its fair enough to say “All I want is U…ranium”

Today was the first day of Bitcoin being a national currency of El Salvador. To celebrate, Bitcoin dropped in price to $46,428 as of this writing – however we don’t expect Bitcoin to be left high and dry. In other news, uranium continues to roll with the Sprott Physical Uranium Trust train showing no signs of stopping.

We wrote bull calendar spreads on Riot Blockchain ($RIOT), Innovio Pharmaceuticals ($INO), Transocean LTD ($RIG) and Energy Fuels ($UUUU)

Mondays aren’t half bad when you write covered calls – they are more than just another day. They are a just another profitable day.

Today we wrote bull calendar spreads with the October / December paper on Energy Fuels ($UUUU). We also wrote some bull calendar spreads with the weeklies on Riot Blockchain ($RIOT) and Innovio Pharmaceuticals ($INO). We picked up a few $DNN and would love to see our bids get filled at $0.10 for the October $1.50 paper there.

The year was 1979, Michael Jackson was climbing the charts with hits like “Don’t Stop Til You Get Enough” and interest rates were climbing as well to as high as 11.2%. We haven’t seen that kind of inflation for decades… until recently. I was listening to a podcast with Jonathan Davis (shown here below) where he talked about a new era of rising rates. I tend to agree. We started the first leg up, we are pausing and now heading back up again.

As for our positions, we got called away on Riot Blockchain ($RIOT) and Innovio Pharmaceuticals ($INO) this week. We will get called away on Transocean LTD ($RIG) next Friday. These positions are starting to move, so we will give them room to run with deep out of the money calls and options on the flipside as they do.

Innovio Pharmaceuticals ($INO) popped today on news that it has received authorization to proceed with Phase 3 trials from Brazil. Muito Bom.

Today we wrote some bull calendar spreads on Energy Fuels ($UUUU) and Denison Mines ($DNN) and bought some Canaan ($CAN)

Uranium continues to creep higher as spot price rose to $33.50 thanks in part to the SPUT (Sprott Physical Uranium Trust) buying more of the physical commodity on the open market.

Today we sold calls / bought Energy Fuels ($UUUU), bought more Denison Mines ($DNN), sold calls / bought Metalla Royalty and Streaming ($MTA), sold calls / bought Innovio Pharmaceuticals ($INO), sold calls / bought Riot Blockchain ($RIOT) and sold calls / bought Canaan ($CAN).

Everything we own was down again today, so we bought more… Energy Fuels ($UUUU), more Denison Mines ($DNN), more Innovio Pharmaceuticals ($INO), more Metalla Royalty and Streaming ($MTA), more Canaan ($CAN), more Transocean ($RIG), and more Mogo Inc. ($MOGO)

With Bitcoin at $47,486 its back above its 30 day moving average and ready to rumble. Speaking of crypto we bought more shares of Canaan ($CAN) and Riot Blockchain ($RIOT) today, along with Energy Fuels ($UUUU), Denison Mines ($DNN), IMV Inc. ($IMV) and Platinum Group Metals ($PLG). We like Bitcoin and Gold here.

Inovio Pharmaceuticals was up 13% today on high volume and busted through our $9.50 calls for tomorrow August 13th. Maybe a minor correction tomorrow is in the cards? Today we bought some Energy Fuels ($UUUU), Denison Mines ($DNN) and more IMV Inc. ($IMV).

IMV Inc. reported some good results from their ovarian cancer drug trial:

Yesterday the stock was up on the news, today its back down.

We acquired some additional shares in IMV Inc. ($IMV) mentioned above, along with Energy Fuels ($UUUU), Denison Mines ($DNN) and Innovio Pharmaceuticals ($INO).