Uranium slightly down

Bitcoin slightly down as well

Silver has rocketed but toppy

A Private Buywrite Fund focused on Uranium, Silver and Bitcoin Equities

Uranium slightly down

Bitcoin slightly down as well

Silver has rocketed but toppy

Energy Fuels $uuuu

Today we wrote sone Feb 7s and bought some Feb 5s and some $dnn

Sphere 3d $any

We bought some more $any

Summary

Still full bear mode out there. Looking to sell more $uuuu 7s tomorrow

Energy Fuels $UUUU

$UUUU is still in a downtrend with some negative divergence. Today we sold some $8 February paper in the morning and bought some $UUUU March 6’s and exercised some $DNN Feb $1’s and bought some $ANY with proceeds.

Denison Mines $DNN

More of the same – adding to share count with some Feb $1s bought last month.

Uranium Royalty Corp $UROY

See above with $UUUU and $DNN

Sphere 3D / Gryphon Mining $ANY

Really digging $ANY here. Bought more today.

Metalla Royalty and Streaming $MTA

Tried to sell some $7.50 Feb Paper but didn’t get the ask price – order expired.

Summary

We’ll be looking for signs of support for $UUUU $DNN and $UROY tomorrow and Friday and write calls accordingly. Looks like $ANY will bust our calls @ $2 – if it does we’ll teeter totter the cash secured puts @ $2 – option premium too good to pass up. We still like the $MTA $7.50 paper and will try to get a fill again tomorrow. Have a good night!

Sold some $uuuu Jan 9s bought some Feb 7s

Tried to sell some $mta Jan 7.50s but nothing filled at the ask

Today we sold the following:

and we bought the following:

Uranium is going balistic. Here is a great podcast with Tim Rotolo, Mike Alkin of The North Shore Indices Uranium ETF and John Ciampaglia of Sprott (Sprott Physical Uranium Trust):

Uranium won big today thanks to $SPUT and friends and the Utes are winning tonight. What a day.

Still on the wrong side of the trade with our inflation assets. We bought more Energy Fuels ($UUUU), Transocean ($RIG) and Denison Mines ($DNN) – argh.

So you’re telling me its not transitory?

Commodities are back in vogue – well at least for now.

Uranium is starting to glow again. Sold more Energy Fuels $UUUU Sept $6 Calls today. Bought some Energy Fuels $UUUU Oct $6 Calls today. Need a play on Dennys ($DNN) but its in no mans land. Tried writing some Sept puts @ $1 but not a lot of meat on that bone. C’mon Dennys.

Gold and Silver looking good here. Still love royalty cos like Metalla – $MTA – gonna listen to http://www.kereport.com/2021/07/27/metalla-royalty-streaming-a-shareholder-update-on-a-wide-range-of-topics/

Crypto seems to be headed higher but might be a head fake – who knows? Canaan ($CAN) was up like 15% today so there’s that.

We’re buying some Biotech cause why not. New position in IMV Inc. ($IMV) – they are battling Cancer and Covid – so thats awesome.

Oil looking slick. Pun intended. $RIG holding strong.

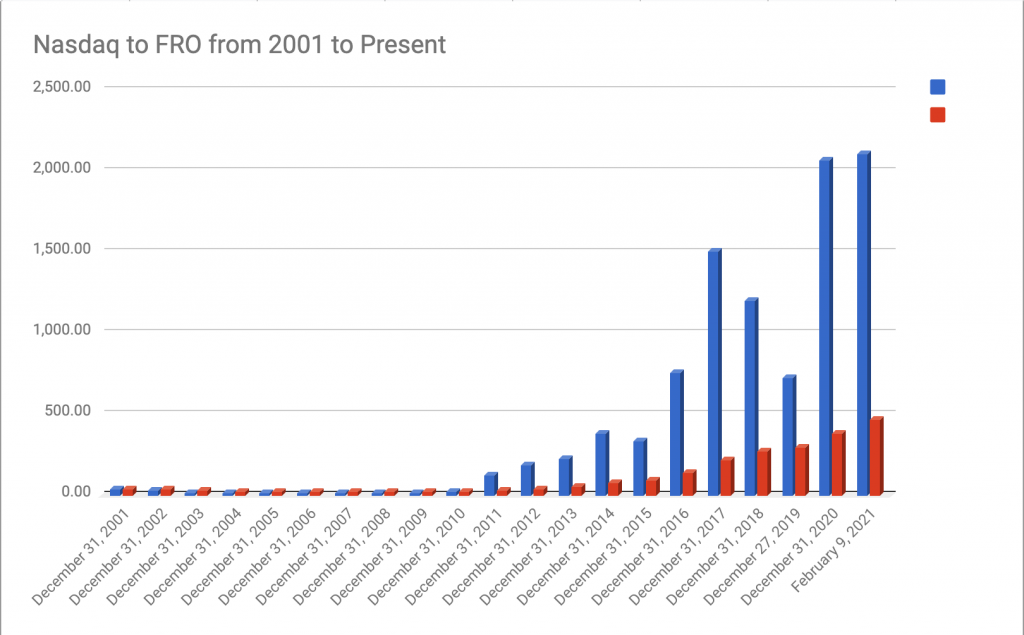

Tankers are going nowhere fast right now and we like them. DHT Holdings, Inc. ($DHT) is our kinetic rocket for the sector. Here is a long-term chart depicting the ratio of the Nasdaq Composite to Frontline Ltd. ($FRO) another tanker company that has been around awhile:

As you can see from this chart, the Nasdaq has really outperformed tankers for the past 10 years or so… a trend that could start reversing itself in the future.