A Private Buywrite Fund focused on Uranium, Silver and Bitcoin Equities

Uranium!

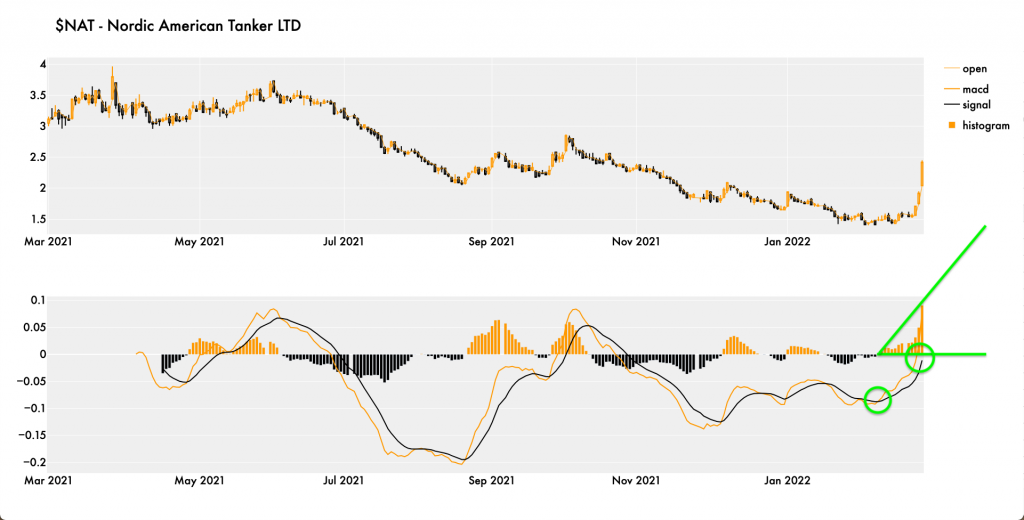

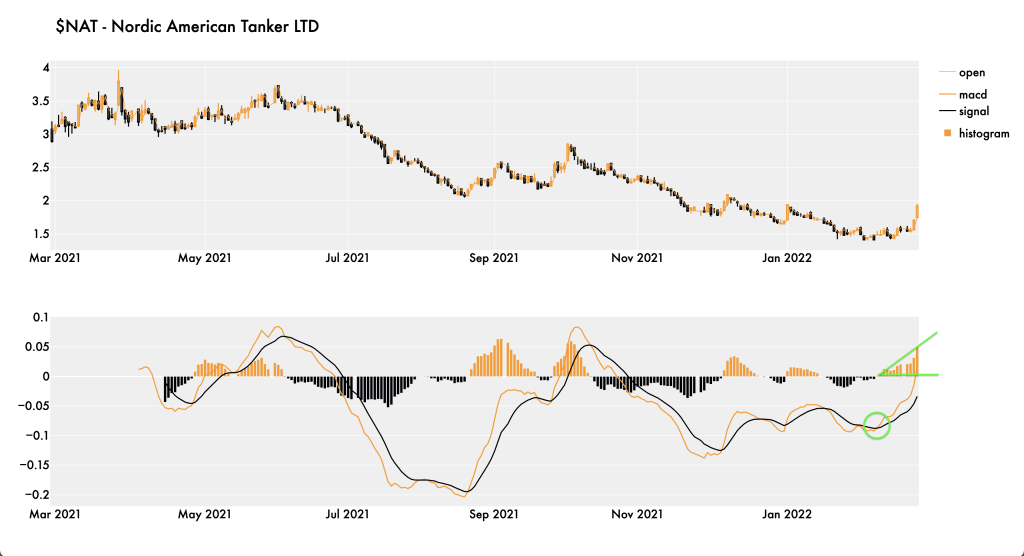

Tankers!

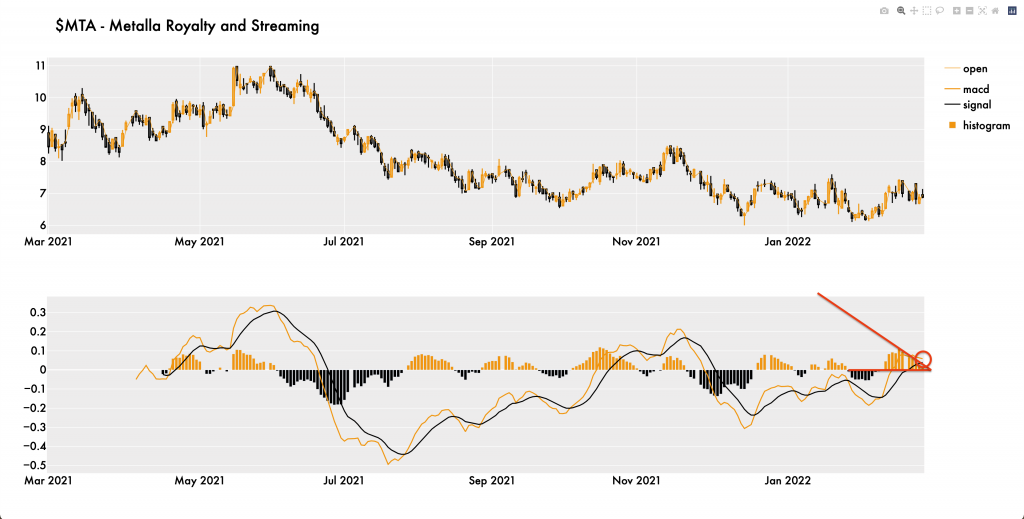

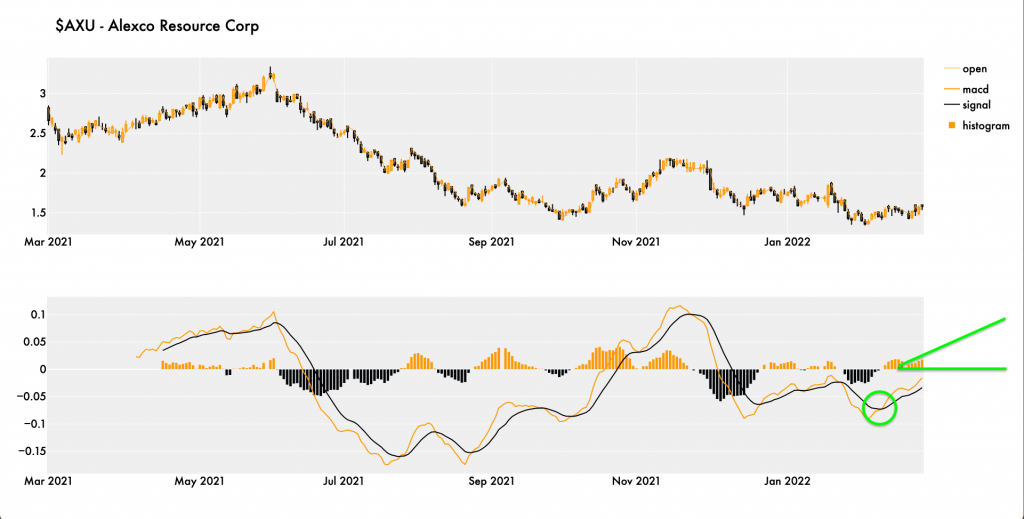

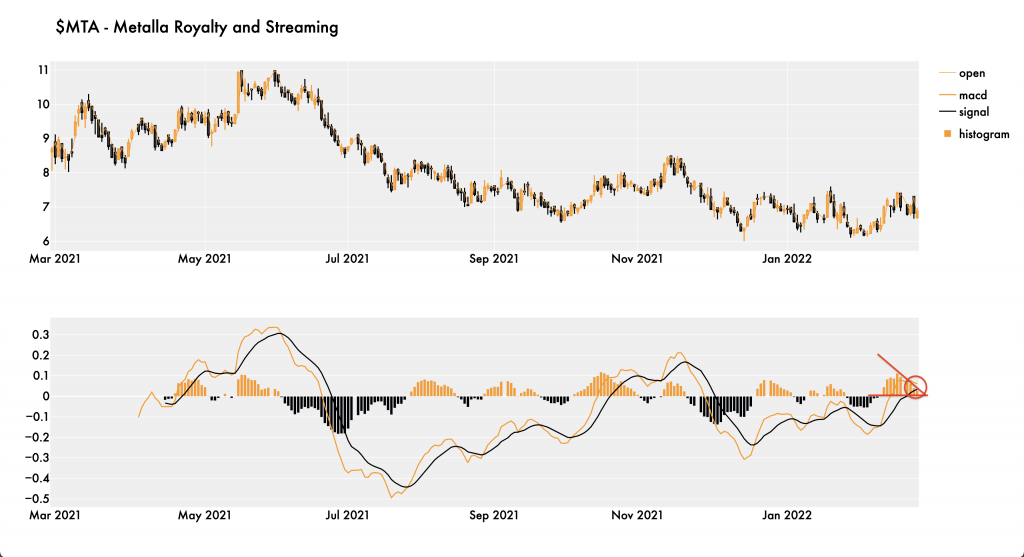

Silver – a mixed bag.

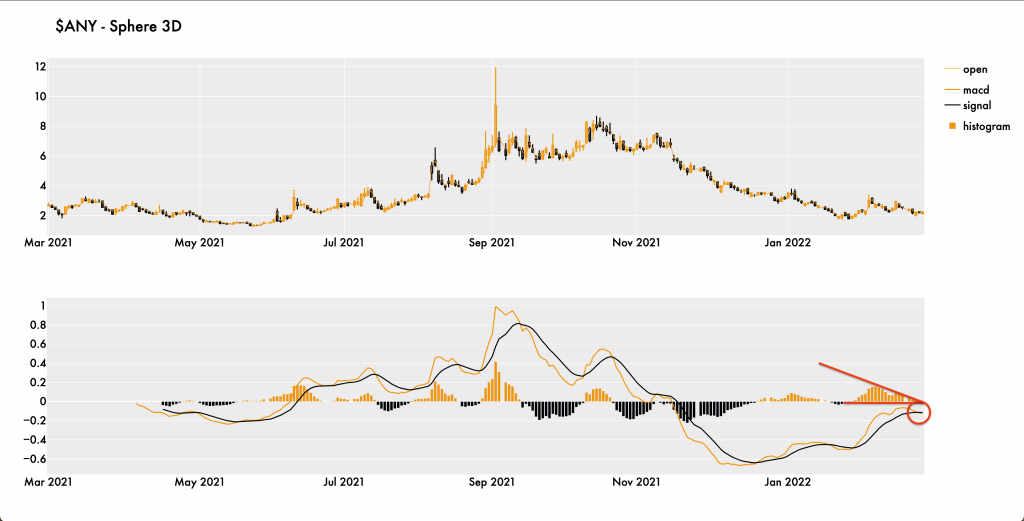

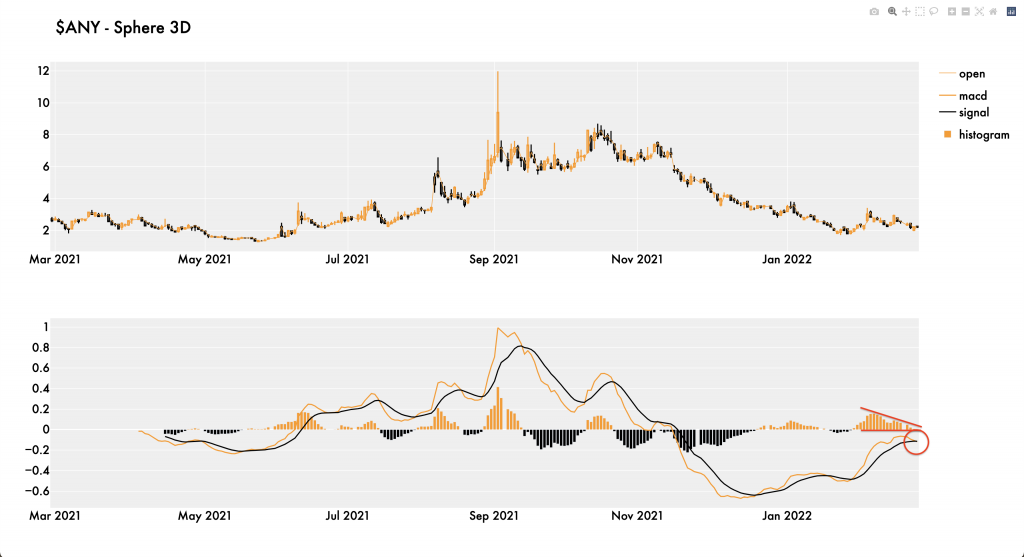

Bitcoin Mining – a mixed bag as well.

Uranium

Tankers

Silver

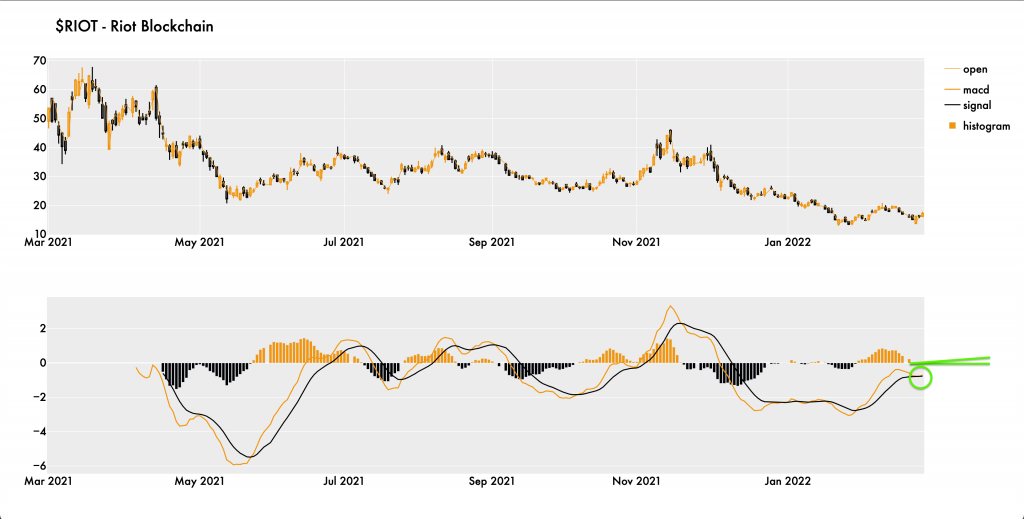

Bitcoin Mining

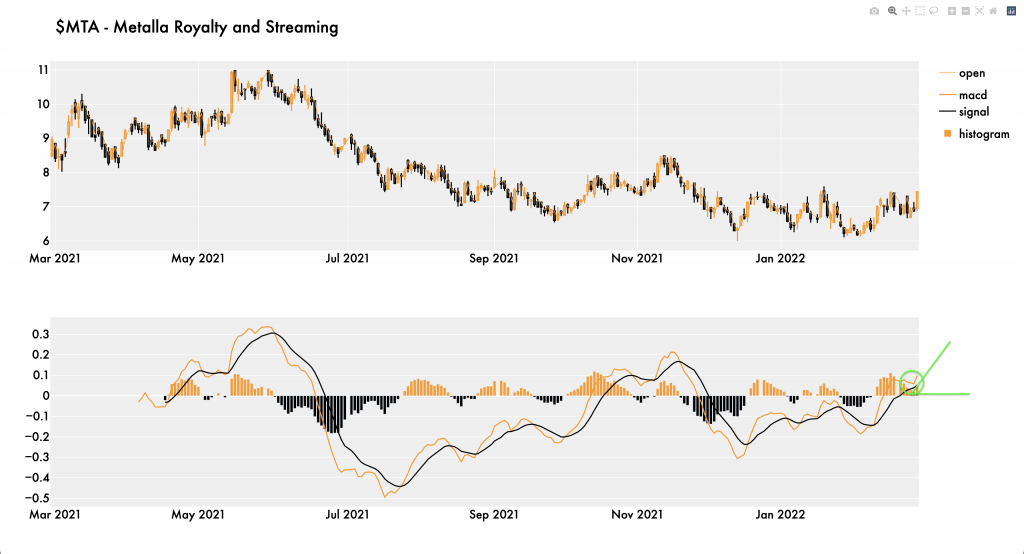

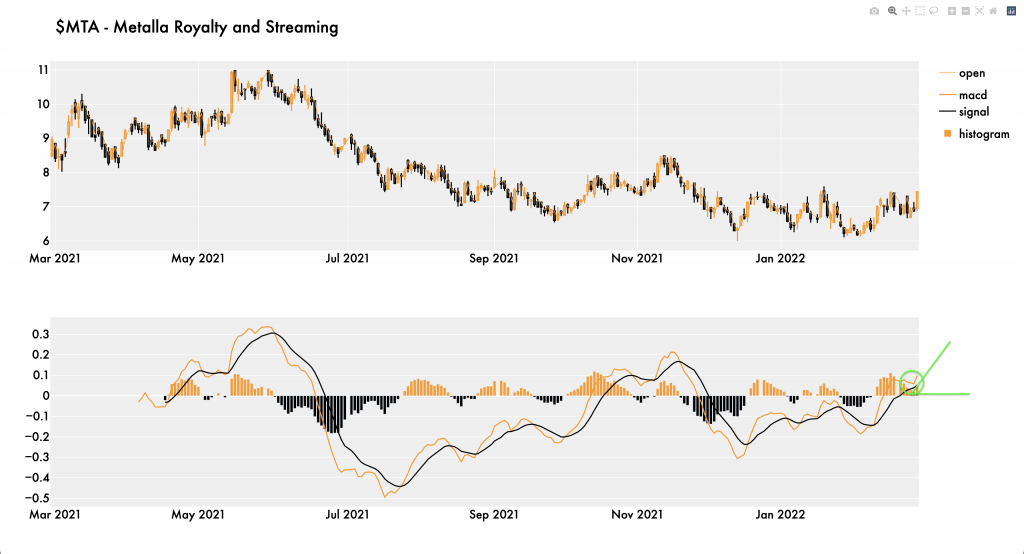

Silver is looking good coming into this week. Here are a few of our favorites, Metalla Royalty and Streaming ($MTA) and Sandstorm Gold ($SAND):

Uranium is a bit suspect.

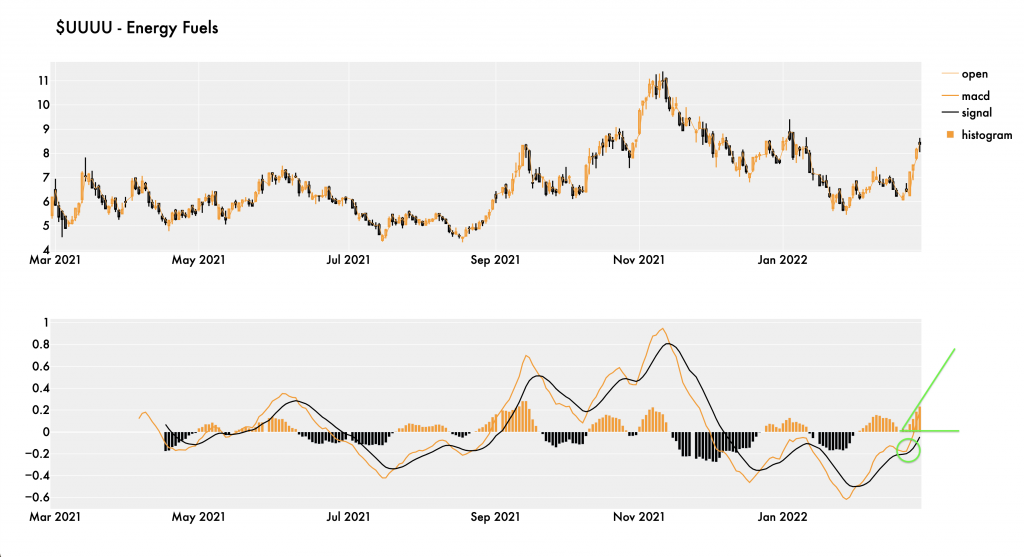

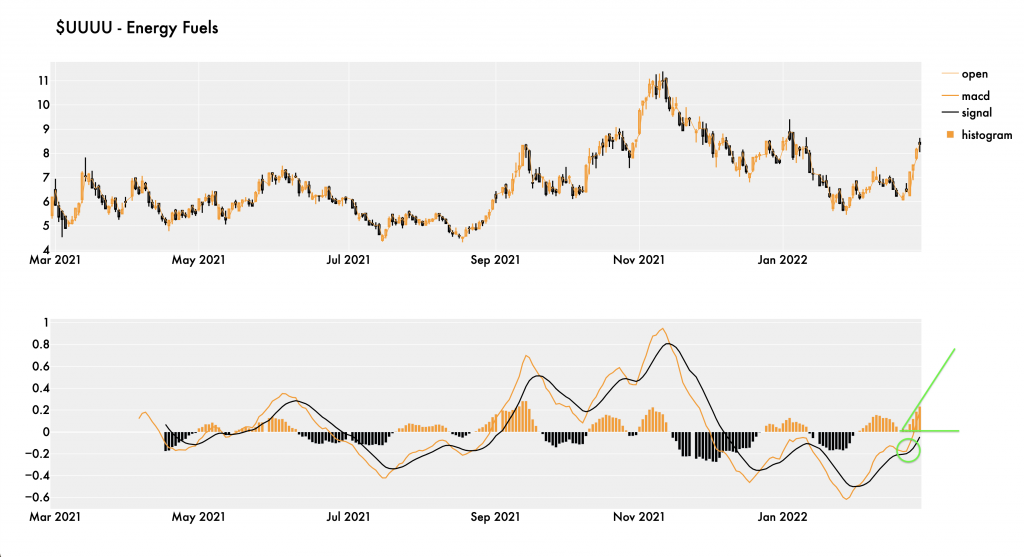

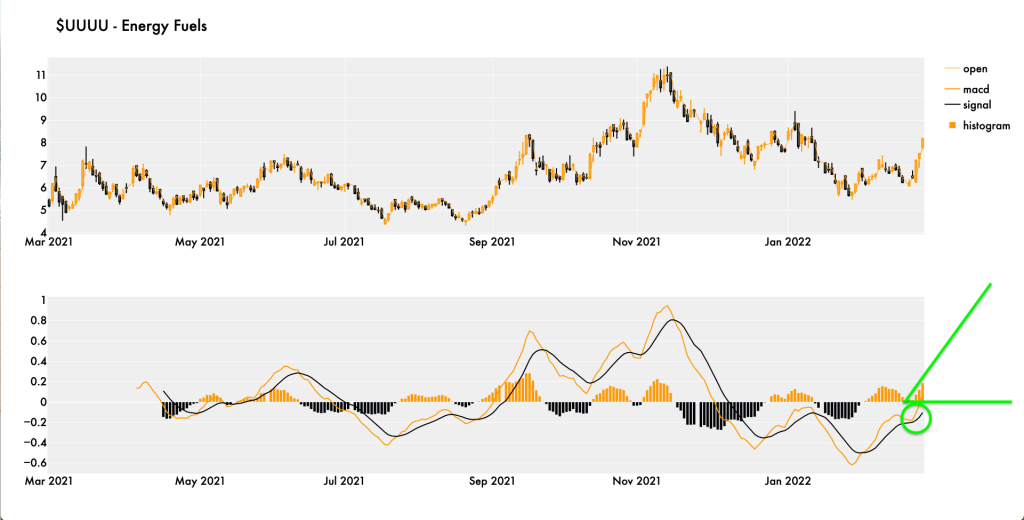

Here is Energy Fuels ($UUUU):

Bitcoin is looking a bit suspect as well.

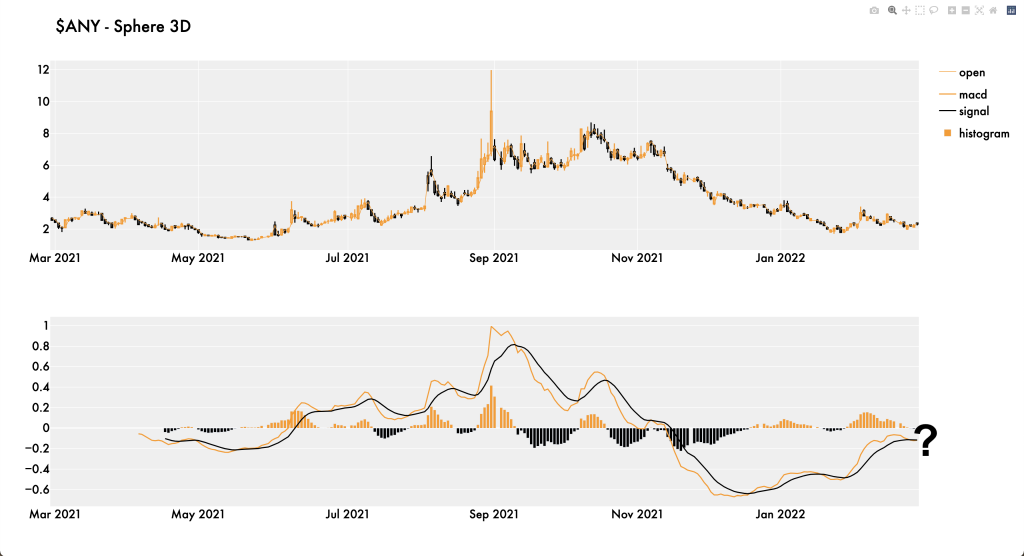

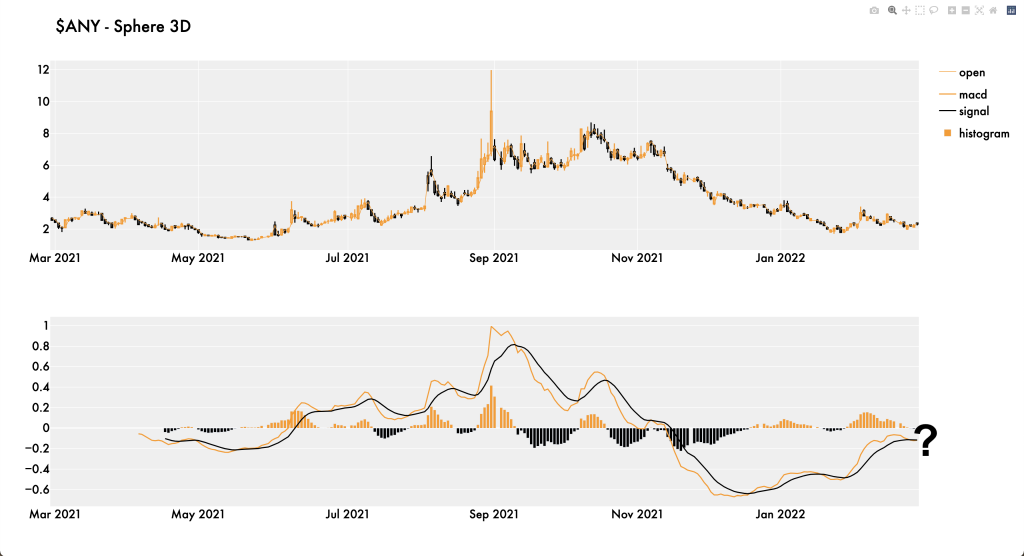

Here is Sphere 3D ($ANY):

Summary: Next week should be interesting, we are looking for Silver to remain strong and Uranium and Bitcoin to potentially correct before heading higher.

Uranium is a go $UUUU

Bitcoin is a go $ANY

Silver on the fence $MTA

and what? Tankers?

Uranium continues to grind slowly higher – is this the trend of something more longterm or a pause before another leg down? We will know more after the Cameco Conference Call tomorrow morning. Here is a chart of $UUUU:

MACD and RSI are curling up…

$ANY is backtesting its breakout and we will buy more at these levels. Bitcoin.

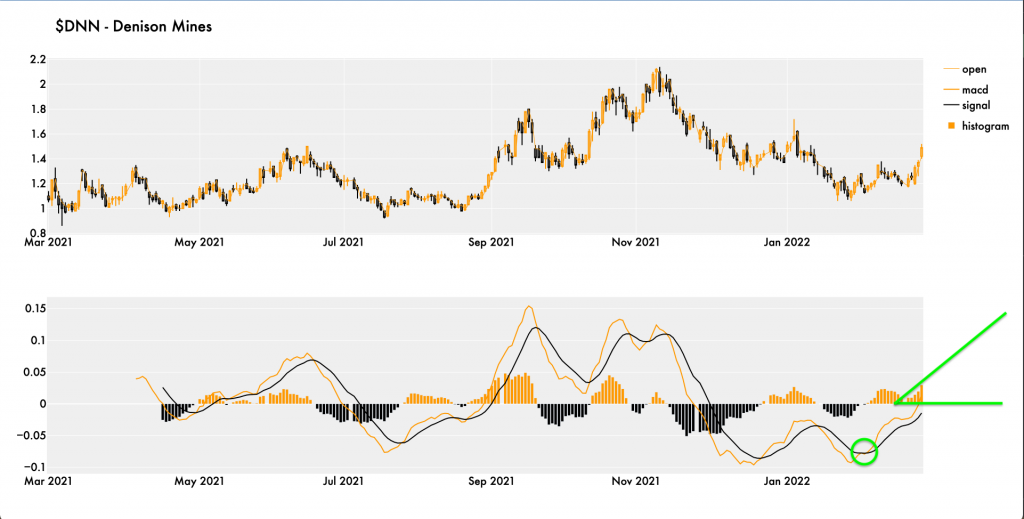

We are also buying some $SAND calls and continue to exercise some $DNN $1 Feb Calls

Silver caught a bit today with the MACD and RSI curling higher. We are looking to expand our position in Metalla Royalty and Streaming $MTA and take some initial positions in some of our favorite royalty plays like $SAND and $MMX.

Uranium continues to chop here – no clear direction up or down at this point. We will continue to write the calls on $UUUU at either $7 or $8 and expand our holdings in $DNN

Bitcoin looks good. We sold some calls in $ANY today and will look to add more common ongoing.

Sphere 3D ($ANY) entered into an agreement to acquire 60K NuMiner Bitcoin miners and their stock shot up after hours. They are definitely gonna bust our calls – which we will re-write next week at higher prices 😒

Will be interesting to see what happens to $UUUU and #uranium tomorrow as well…

Facebook (or Meta?) ($FB) reported after hours and got whacked to the tune of -20%. Tomorrow could be a tough day for all risk assets including #uranium and #bitcoin. We will keep a close eye on $UUUU and $ANY. We are looking to write more calls on $UUUU and that will depend on where the price lands tomorrow. North of $6.50 we write the Feb $8’s (if there’s any juice left in em) and south of $6.50 we write more Feb $7’s.

Energy Fuels ($UUUU)

We are starting to see some green shoots in uranium equities like $UUUU. We are looking to see the MACD crossover next. We are looking to write the Feb $8’s tomorrow and buy more $UUUU, $DNN and $ANY with proceeds.

Sphere 3D ($ANY)

Bitcoin is showing some green shoots of its own. We will be looking to buy more $ANY here.