A Private Buywrite Fund focused on Uranium, Silver and Bitcoin Equities

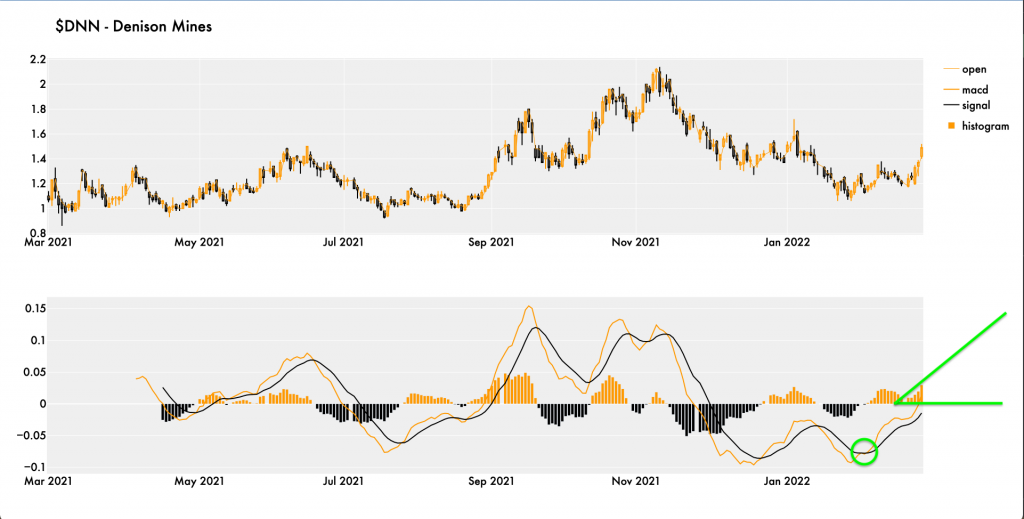

Uranium!

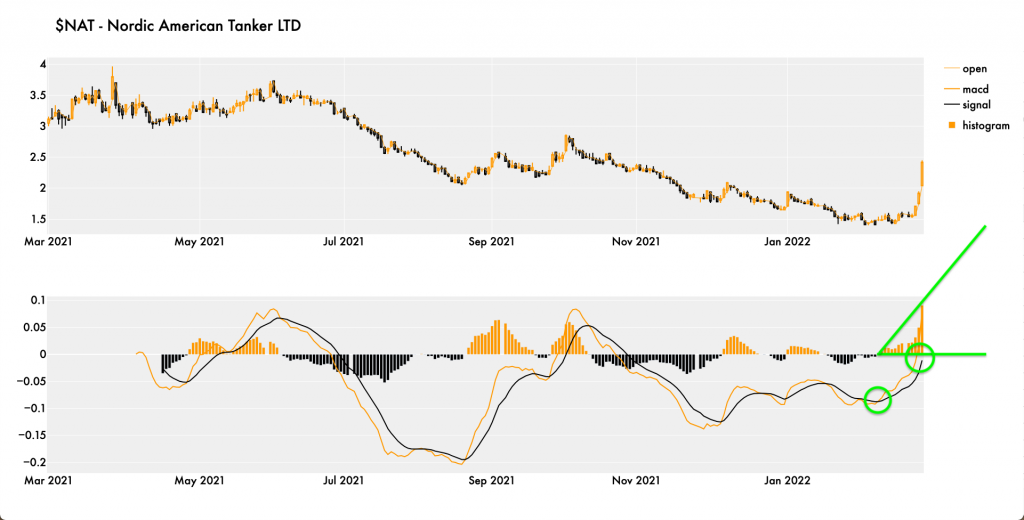

Tankers!

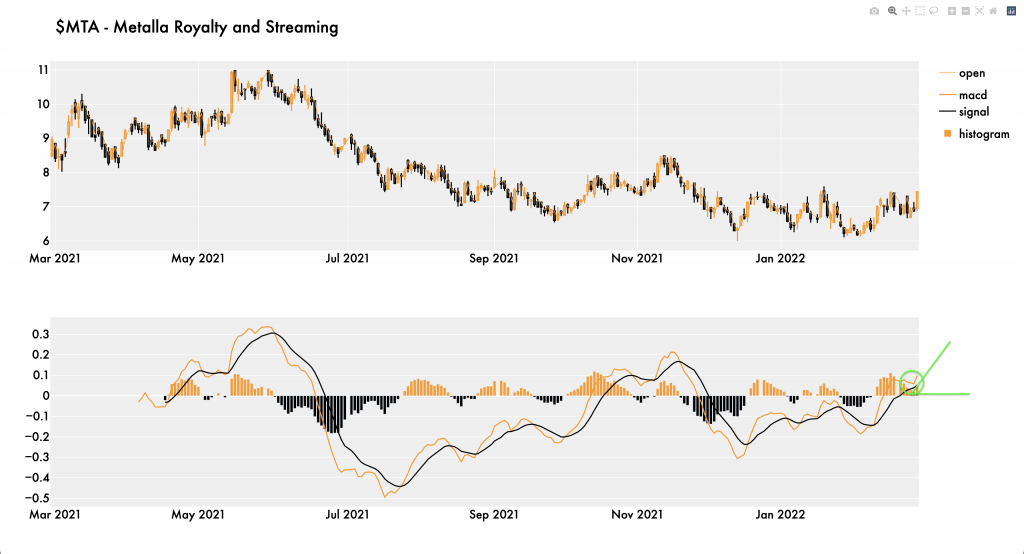

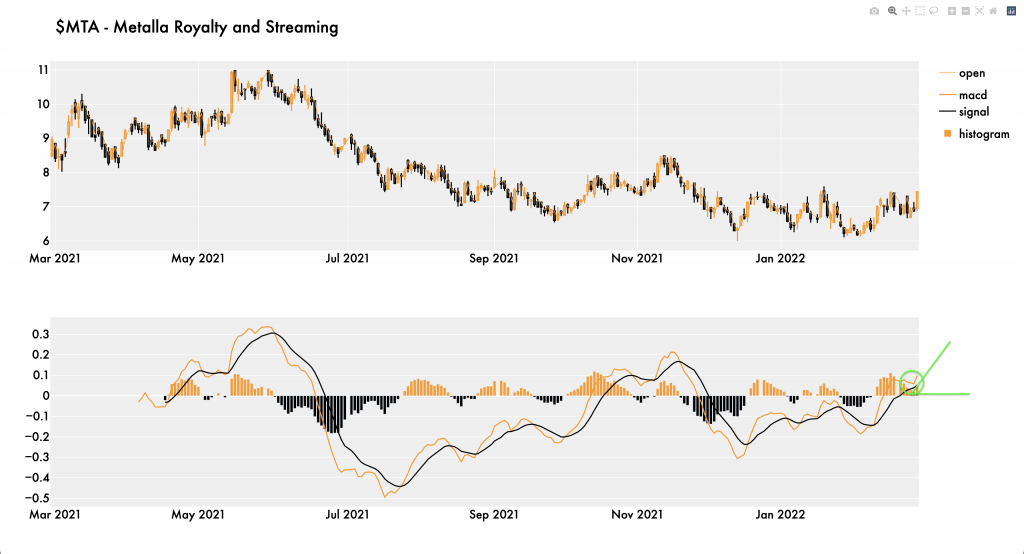

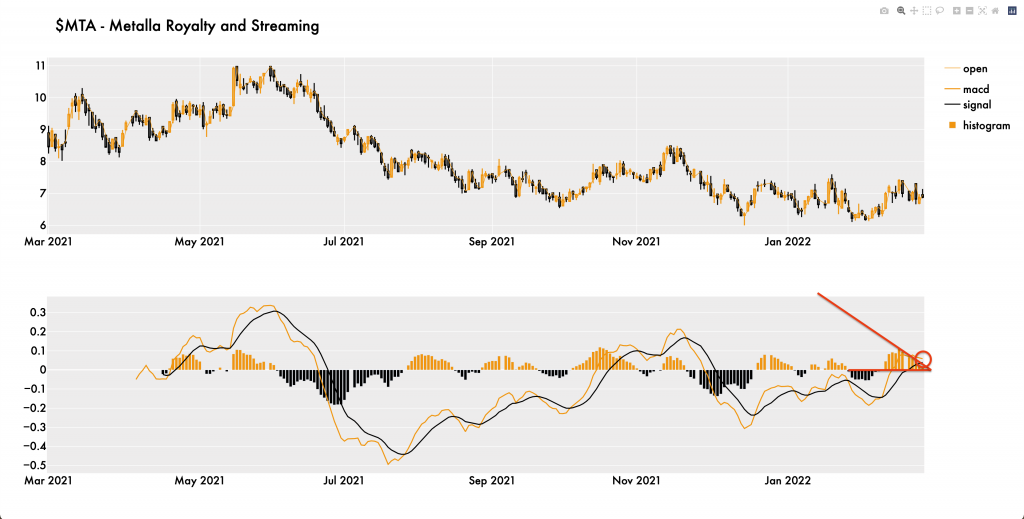

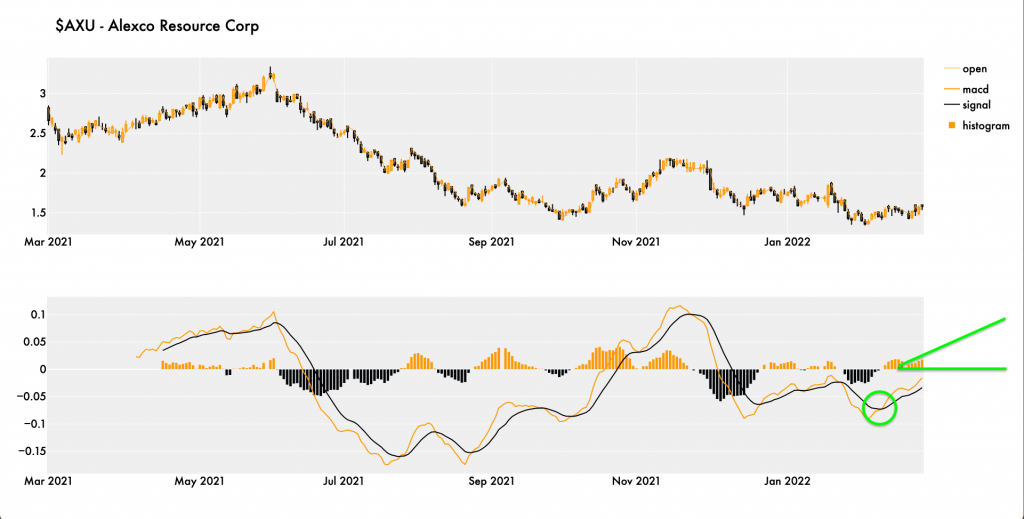

Silver – a mixed bag.

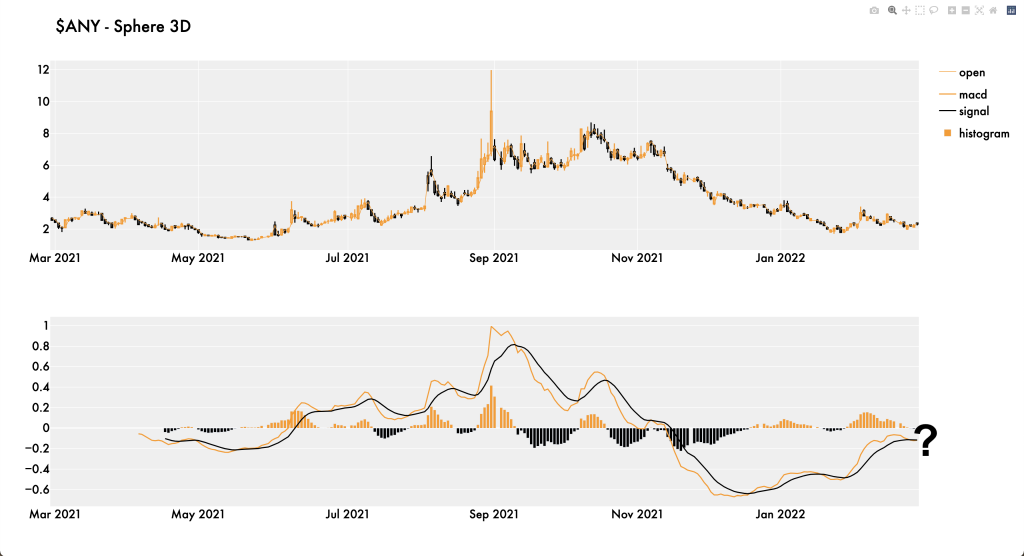

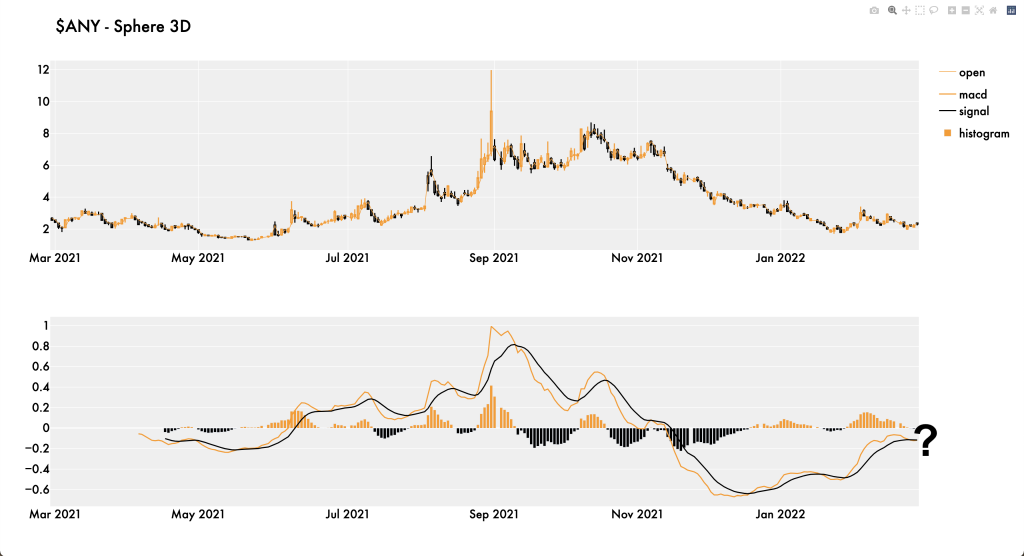

Bitcoin Mining – a mixed bag as well.

Silver caught a bit today with the MACD and RSI curling higher. We are looking to expand our position in Metalla Royalty and Streaming $MTA and take some initial positions in some of our favorite royalty plays like $SAND and $MMX.

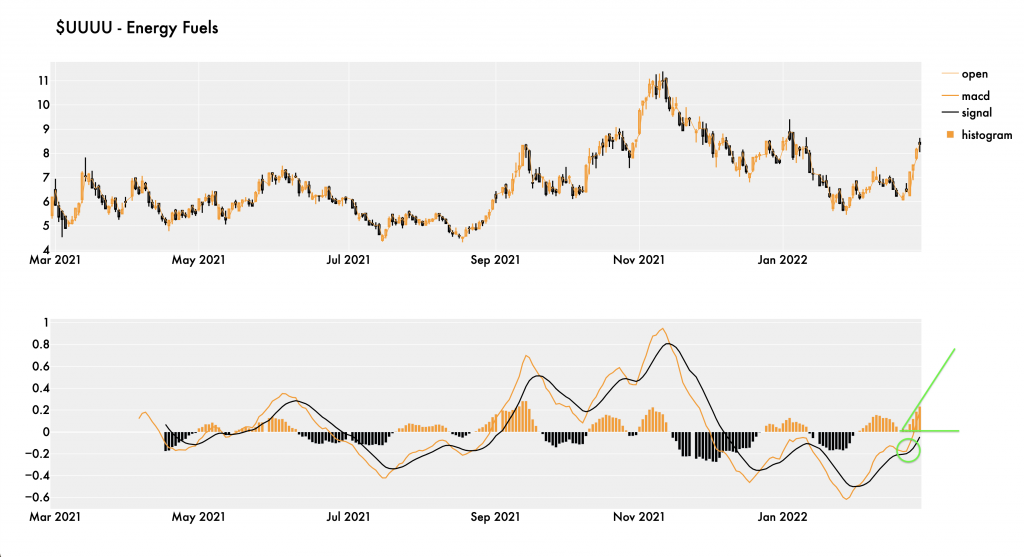

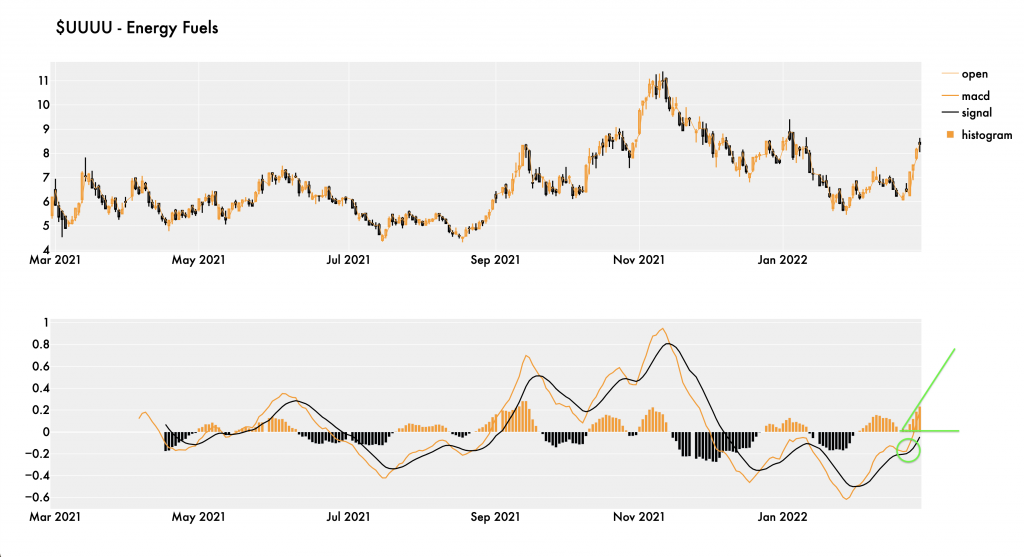

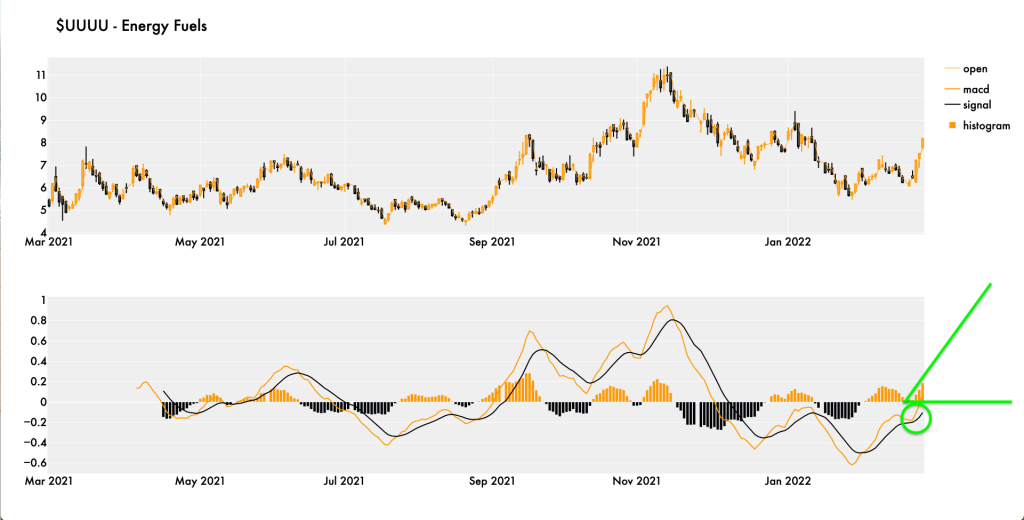

Uranium continues to chop here – no clear direction up or down at this point. We will continue to write the calls on $UUUU at either $7 or $8 and expand our holdings in $DNN

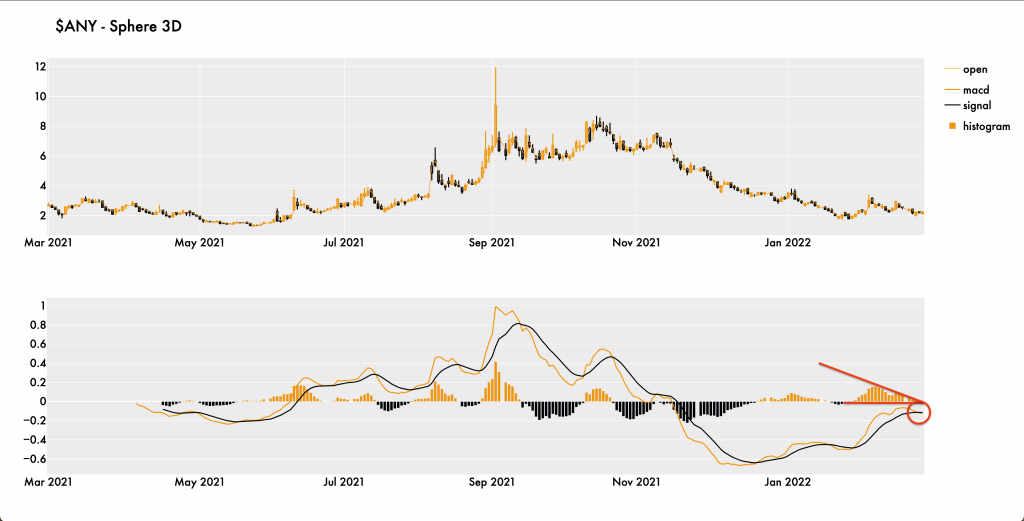

Bitcoin looks good. We sold some calls in $ANY today and will look to add more common ongoing.

Facebook (or Meta?) ($FB) reported after hours and got whacked to the tune of -20%. Tomorrow could be a tough day for all risk assets including #uranium and #bitcoin. We will keep a close eye on $UUUU and $ANY. We are looking to write more calls on $UUUU and that will depend on where the price lands tomorrow. North of $6.50 we write the Feb $8’s (if there’s any juice left in em) and south of $6.50 we write more Feb $7’s.

Energy Fuels ($UUUU) ☢️

Today we sold some February $7 paper and bought some common shares of $UUUU and paid a dividend with the proceeds. Energy Fuels is still looking weak:

so we will continue to write the Feb $7 paper until it can gain $6.50 – at which case we would start to write the Feb $8 paper – and if the common drops below $5.50 we will start to write the Feb $6 paper. On the flip side with the proceeds we will raise cash and possibly buy more longer dated calls / puts or common.

Sphere 3D Corp ($ANY)

Gotta love it when you write $2 weeklies and the stock ends the week @ $1.98. We’re gonna try to write these weeklies again on Monday. Hopefully we can write the $2’s – if it rockets we’ll see if we can get something for the $2.50’s. Right now the Feb 4 $2’s are selling for $0.13 – which would be a $0.13 x 52 = $6.76 annual return or a 341% return on today’s share price of $1.98.

Chart starting to look slightly better than absolute dumpster fire. Buy time? Bitcoin is a manic beast

Today we sold the following:

and we bought the following:

Today was the first day of Bitcoin being a national currency of El Salvador. To celebrate, Bitcoin dropped in price to $46,428 as of this writing – however we don’t expect Bitcoin to be left high and dry. In other news, uranium continues to roll with the Sprott Physical Uranium Trust train showing no signs of stopping.

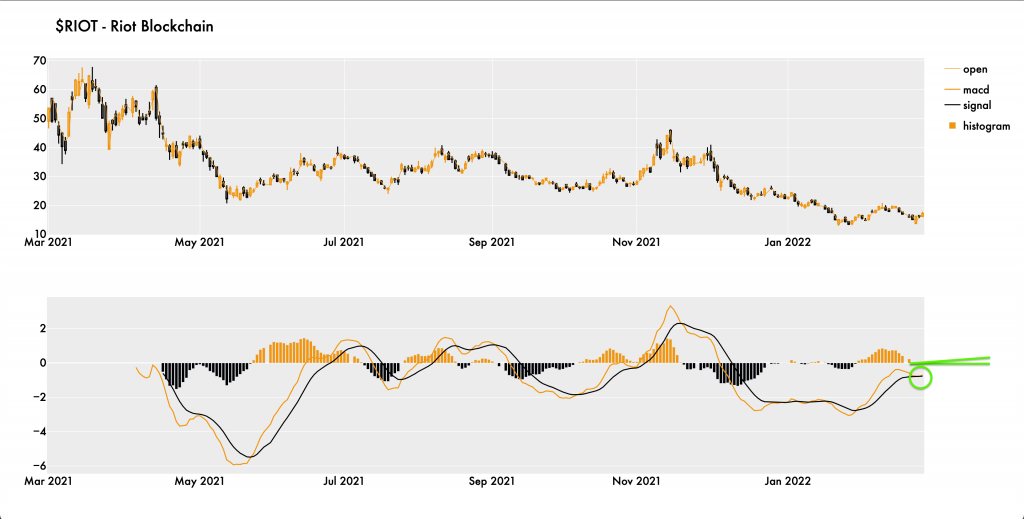

We wrote bull calendar spreads on Riot Blockchain ($RIOT), Innovio Pharmaceuticals ($INO), Transocean LTD ($RIG) and Energy Fuels ($UUUU)

Uranium continues to shine as Sprott removes supply from the market at breakneck speed with their Sprott Uranium Trust vehicle. It will be interesting to see how spot moves next week – will it continue to march higher or take a breather?

In other news, bitcoin is back over $50K, gold and silver got a pop and will oil become more volatile with these missile attacks in Saudi Arabia?

Here we are in September of 2021. Uranium had some pretty good follow through from yesterday. Bitcoin is hanging around at $47K and Oil is at $68 / barrel. Today we wrote some Bull Calendar Spreads on Energy Fuels ($UUUU) and Denison Mines ($DNN). Given the bullish momentum, we are going to hang onto the calls we are generating into the fall. For uranium the future’s so bright, gotta wear shades.

The year was 1979, Michael Jackson was climbing the charts with hits like “Don’t Stop Til You Get Enough” and interest rates were climbing as well to as high as 11.2%. We haven’t seen that kind of inflation for decades… until recently. I was listening to a podcast with Jonathan Davis (shown here below) where he talked about a new era of rising rates. I tend to agree. We started the first leg up, we are pausing and now heading back up again.

As for our positions, we got called away on Riot Blockchain ($RIOT) and Innovio Pharmaceuticals ($INO) this week. We will get called away on Transocean LTD ($RIG) next Friday. These positions are starting to move, so we will give them room to run with deep out of the money calls and options on the flipside as they do.